OK, so do we really know who’s driving the Bitcoin wagon, or is this a ride on the mystery train?

Is it the Winklevoss Twins? What about all the Bitcoin seized from Silkroad by the FBI, siphoned from Mt. Gox or other serial goblins and ghosts in the global machine?

What happened? A tipping point was reached and then was receded recently…

Everything was going nicely for Bitcoin (all over the place..) but generally up! It all seemed legitimate, EBay said they were seriously considering accepting the Bitcoin!

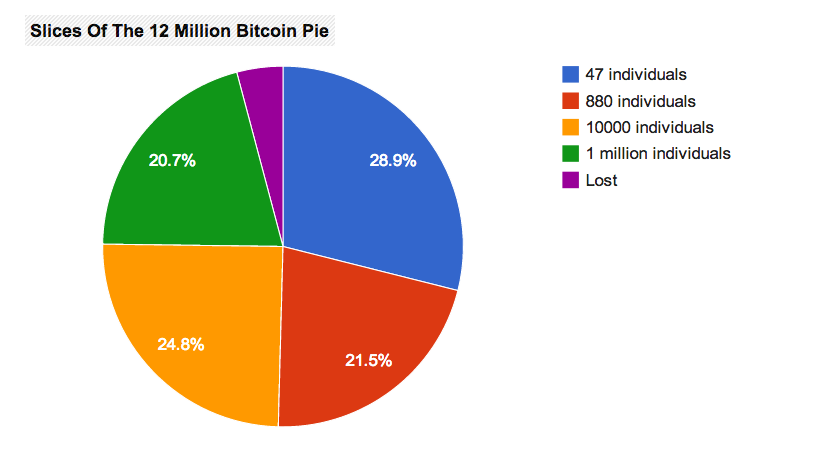

It had achieved a balanced ownership so everyone thought… It was still busy (?) kicking out the drugs and other contraband, supposedly cleaning up its’ act and on the way to Global Market Trading and New Currency Status!

June 14, 2014: Bitcoin prices were down more than 5% to $563 on Saturday morning as the cryptocurrency faced its worst crisis of confidence since the fall of Mt. Gox.

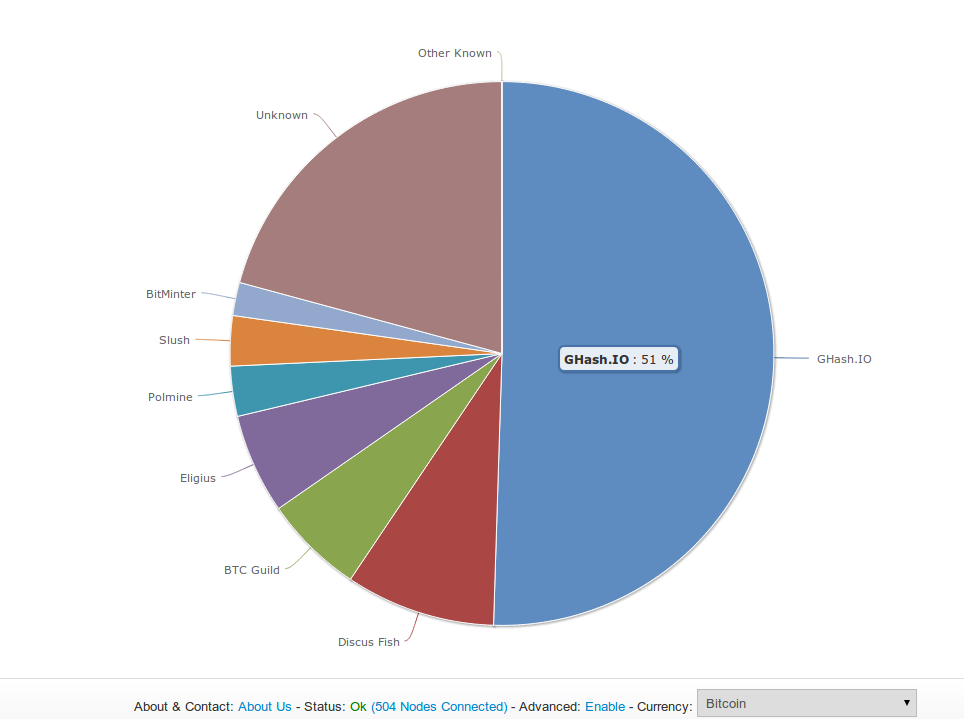

There is only way to hack the entire Bitcoin network, which has continued to hum along in the face of numerous Bitcoin business failures. It involves a series of group of Bitcoin miners taking control of 51% of the Bitcoin’s processing power, thus giving them the power to confirm transactions that don’t exist. Miners are simply computers that unscramble the encrypted series of numbers attached to every Bitcoin transaction. There is profit in numbers, and many miners have formed large pools to extract the maximum amount of profit for their work.

As a completely unregulated global currency made out of computer code, the only thing that has prevented the 51% threshold from being reached has been a form of mutually assured destruction: As soon as the 51% figure is reached, the price of Bitcoin will tank, leaving the digital junta little time to make much of a profit.

On Friday, mining pool GHash’s share of the Bitcoin network ticked 51%:

The situation was momentarily resolved after a member of GHash agreed to remove some of its resources from the pool. GHash’s mining share has since retreated to 43%.

But there is now debate raging in Bitcoin world about what to do next. One commentator who wished to remain anonymous told BI, “This is not Bitcoin anymore, it’s centralized GHashcoin….They are killing what is a big part of Bitcoins value.”

Two Cornell computer scientists posted a note to HackingDistributed confirming that, indeed, this is a doomsday scenario:

Is this really Armageddon? Yes, it is. GHash is in a position to exercise complete control over which transactions appear on the blockchain and which miners reap mining rewards. They could keep 100% of the mining profits to themselves if they so chose. Bitcoin is currently an expensive distributed database under the control of a single entity, albeit one whose maintenance requires constantly burning energy — worst of all worlds.

In a blog post Friday, Gavin Andresen, Bitcoin’s lead developer, advised urged miners to leave GHash, but said the danger the network faced was limited because it would freeze up before GHash got too far with an attack, and that other solutions could be found.

In an interview with Caleb Chen of CryptoCoinNews, a spokesman for GHash said the firm had no intention of attacking the network but was unapologetic about the pool’s heft in the system. “We understand that the Bitcoin community strongly reacts to GHash.IO’s percentage of the total hash rate,” Jeffrey Smith said. “However, we would never do anything to harm the Bitcoin economy; we believe in it. We have invested all our effort, time and money into the development of the Bitcoin economy. We agree that mining should be decentralized, but you cannot blame GHash.IO for being the #1 mining pool.”

The two Cornell researchers, Ittay Eyal, and Emin Gün Sirer, now propose creating a “hard fork” on the Bitcoin network, a set-aside part of Bitcoin’s transaction ledger that would sacrifice some Bitcoin attributes in the name of preventing another similar attack. Others have proposed creating a peer-to-peer network of mining nodes which, instead of being able to access the entire blockchain, only target specified branches.

There is a third way, the Eyal and Sirer say, which seems to describe the current situation:

…We can carry on as if nothing of importance happened. GHash will be on their best behavior for the next few weeks, and Bitcoin will limp along. What will bring the actual demise of Bitcoin is the subject of a future blog post, but this is by no means the end.

At the end of his post, Andresen said what the 51% moment clearly indicated: “Bitoin is still a work in progress.”

Read the original story: http://www.businessinsider.com/today-bitcoins-doomsday-scenario-arrived-2014-6

Leave a Reply